Frugal living has many real-world benefits. For people who are living from paycheck to paycheck, it’s time to make a change. Just like everyone has the same number of hours in a day but some get more done than others. It’s time to make more out of your money and live a happier life.

Frugal Living will help you stretch your money and make it go further. It will help you become better at money management and control impulse purchases like the latest iPhones. The benefits of adopting this lifestyle include financial independence and financial stability well into retirement.

Look at our guide on how to live the frugal lifestyle

1- Reduce your debt faster

I always say that the first thing you do with excess money is to reduce your debt. Ensure that you’re out of those high-interest schemes that are designed to keep sucking away at your money. Pay off credit cards, loans, and other debt and imagine a mailbox filled with holiday brochures instead of bills.

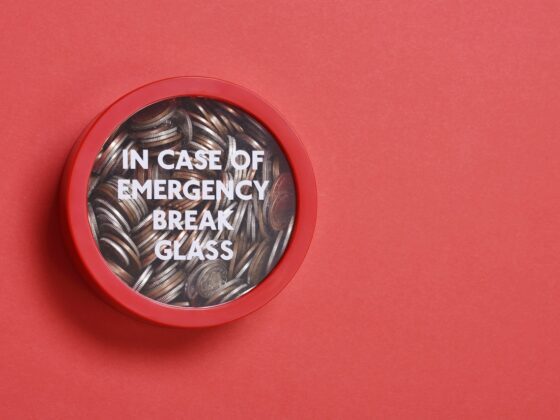

2 -Build your emergence fund

Building an emergency fund is the second most important thing that you can do. Keep assuring money that you save and try to build at least 6 months’ worth of living expenses. this money can come in handy for the emergencies that insurance won’t cover or other such expenses.

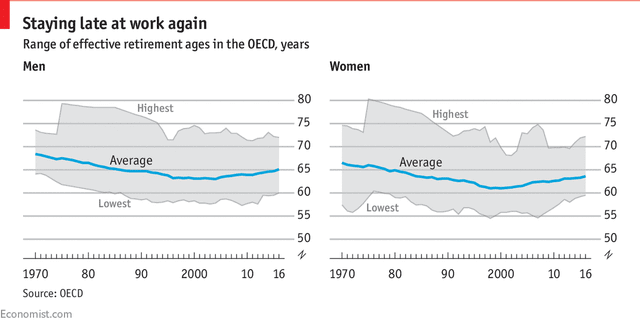

3 – Be more confident about your retirement

Retirement savings is a growing worry among many households. A greater aging population is putting pressure on governments resulting in revision in the retirement age. Saving money and investing it for a higher return can help build your wealth

4- Improved credit scores

Lower debt leads to improved scores and improved scores opens a range of investment possibilities. If you want to buy big-ticket items like a house. the lower scores will mean that you can fund a larger part of the purchase. in some cases, it can also lead to lower interest rates. Check your UAE credit scores here AECB

5 – Spend more time exploring the world

Frugal living allows you to spend more time doing the things you want. Family trips to Europe, a cruise, a road trip. Depending on where you live the option is endless. They have always been there but you were too busy to see.

6 – You bank account will grow

Frugal living guarantees that your savings will increase. This is money you can put into an investment, emergencies supporting the less fortunate. Investing this money and letting the power of compounding work can work wonders or your retirement surplus. This would be a far cry from when you used to live paycheck to paycheck

7- Buy out that house you always wanted

You can finally get rid of that life-long mortgage payment. Imagine if you could pay off your 30-year mortgage in just 10 years. Pay a little more every month and it will cut years off the schedule

8 – Worry less about your financial situation

As you get older the stress about your finances tends to weigh on your mind more and more. Frugal living, saving, investing early are all ways in which you can reduce that level of stress. You will be more relaxed, more in control, more self-confident

Frugal living is a lifestyle choice just like not having kids or being vegan. It requires sacrifice and it has benefits to the ones who practice it. All you need to do is start.