Saving is still crucial in building retirement funds. It seems that saving alone cannot provide the funds that you will require especially for those who are no on any pension – expats.

Investing early must be part of your strategy

Remember you can only invest the money that you have and for that, you must save. So, saving and investment ago hand in hand.

Saving builds a cushion that can be accessed in an emergency, to buy immediate purchase pay or bills. Etc.

This pandemic has shown us what it is to hold on to cash. I have most of my money tied up in investments but I’ve always maintained a healthy cash reserve to take care of family emergencies. This money is sitting in a bank account – a low interest-paying bank account. The real value of this money is being eroded by inflation.

Inflation leads to a drop in the purchasing power of your money. You see AED.1000 ($272) in your account month on month but that is decreasing by 2%-3% every year. So that retirement home you thought would cost about INR.30000 ($408) per year will cost about $800 -$1000) when you finally retire.

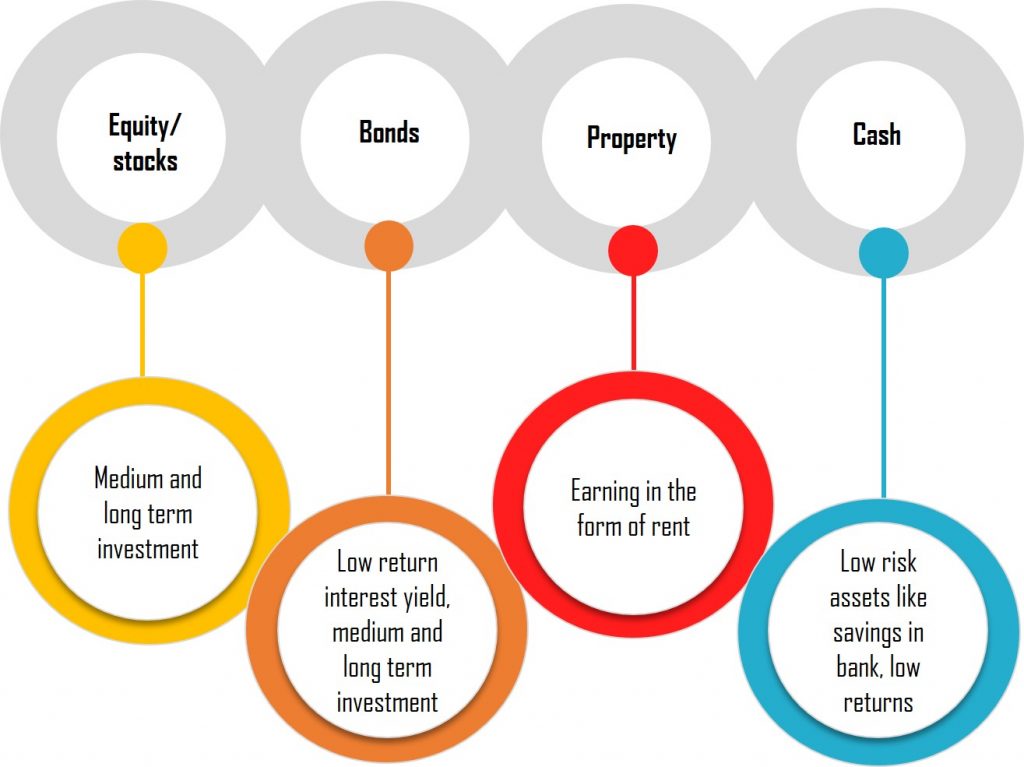

Investing money can help negate this erosion and build on the buying power of your money. The Sensex has returned about 9% (2014-2018) the S&P has average annualized return has been 9.8% over 90 years. All investments come with risk. You have many instruments that you can invest in Gold, equity, bonds, Property

The rise of Robo-advisers has made diversification even easier.

Investing early also adds the power of compounding that further helps your money grow. Compounding grows not only your money but the interest that has accrued. This can all help towards long term savings.

First things first – build an emergency fund, clear of all your debts then start building your investment funds.

Investing is a personal journey. Try not to blindly jump into the many recommendations made by friends, Jim Cramer, and other Investment gurus. opt instead to do your research on the risks associated and the past performance. Increase your financial IQ by reading books and articles. Buy low and hold.