In the dynamic world of stock trading, having the right tools can make all the difference between success and missed opportunities. For traders who swear by technical analysis and quantitative factors, Finviz screeners emerge as a game-changer. This versatile tool caters to a spectrum of trading styles, providing invaluable insights and opportunities. Let’s delve into how Finviz screeners can benefit various types of traders.

Swing Trading: Riding the Waves of Trends

Swing traders navigate the tides of short to medium-term price movements within established trends. Finviz screeners become their compass, identifying stocks that align with specific technical criteria. Whether it’s chart patterns, moving average crossovers, or volatility metrics, the screener empowers swing traders to fine-tune their strategies with precision.

Day Trading: Seizing Intraday Opportunities

For day traders, time is of the essence. Finviz screeners, with real-time data and quick filters, prove indispensable. Filtering stocks based on intraday volatility, liquidity, and other key criteria allows day traders to pounce on fleeting opportunities. In the fast-paced world of day trading, having up-to-the-minute information is not a luxury—it’s a necessity.

Trend Following: Capturing the Momentum

Identifying stocks in strong trends is the hallmark of trend-following strategies. Finviz facilitates this by filtering stocks trading above or below specific moving averages, forming chart patterns indicative of trend continuation, or exhibiting relative strength. For trend followers, the screener acts as a beacon, guiding them toward stocks poised for momentum.

Momentum Trading: Riding the Wave of Strength

Momentum traders thrive on stocks showing robust upward or downward momentum. Finviz screeners offer a curated selection, allowing users to filter stocks based on metrics like relative strength, volume surges, or recent price performance. It’s a treasure trove for momentum traders seeking the next big move.

Value Investing: Merging Fundamentals with Technicals

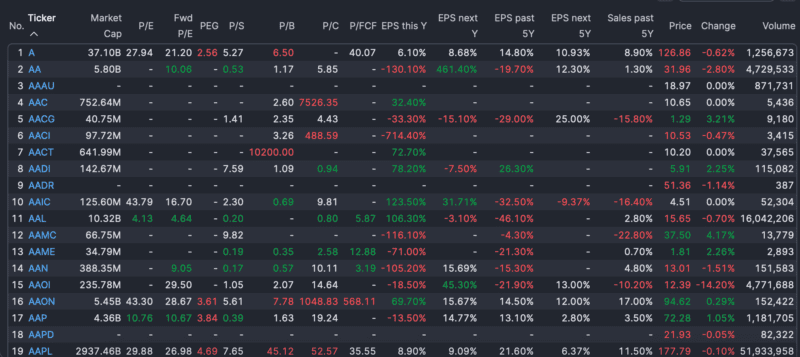

While Finviz is renowned for technical analysis, it doesn’t neglect the fundamentals. Value investors can leverage the screener to identify stocks with specific fundamental criteria—low P/E ratios, high dividend yields, or strong earnings growth. It’s a bridge between the worlds of technical and fundamental analysis.

Event-Driven Trading: Capitalizing on Catalysts

For traders eyeing specific events like earnings releases or FDA approvals, Finviz screeners act as a spotlight. By filtering stocks with upcoming events, traders can align their strategies with catalysts that might trigger significant price movements.

Pattern Recognition: Visualizing Opportunities

Traders relying on chart patterns find a visual ally in Finviz. The screener allows users to filter for stocks exhibiting patterns like head and shoulders, flags, or triangles. The visual representation of charts simplifies pattern recognition, making it an invaluable tool for technical analysts.

Quantitative Trading: Algorithms at Your Fingertips

Quantitative traders, driven by mathematical models and algorithms, find Finviz to be a playground of possibilities. The screener’s customization options accommodate various quantitative factors, enabling traders to fine-tune their filters according to the intricacies of their strategies.

Finviz’s flexibility and diverse array of filters make it a Swiss Army knife for traders. However, it’s crucial for traders to tailor the screener to their unique strategies, using it as a complement to thorough research and analysis. As markets evolve, having the right tool in your arsenal can be the key to staying ahead in the game, and Finviz screeners are undoubtedly a potent ally for traders of all stripes.