For many, financial planning can feel like a daunting task, full of complex concepts and confusing jargon. It’s no wonder that the topic of money often feels overwhelming. But what if I told you that financial planning can be simple and empowering?

With the right guidance, anyone can navigate their finances and create the life they envision. My friend Mark, a financial advisor with decades of experience, constantly reminds me that money is simply a tool. Used wisely, it can help you achieve your goals.

Let’s break down financial planning into 7 actionable steps.

Step 1 – The Essential Money Mindset

Before diving into numbers, it’s vital to address your beliefs about money. Did you grow up learning that “money doesn’t grow on trees”? Shift that thinking. See money as a resource that, when managed correctly, can fuel your dreams and offer financial security.

Step 2 – Financial Planning 101: Mastering Your Budget

Budgeting is a powerful financial planning tool. It’s your roadmap to financial success! Many people shy away from the word ‘budget‘, fearing it means endless restrictions. However, budgeting is about making conscious, informed choices about your money.

Here’s a simple budgeting method:

- Track Your Income: Note down every source of money you receive.

- Track Your Expenses: For a month, write down every expense. Be honest with yourself!

- Organize: Group your spending into categories like Needs, Wants, and Savings.

- Set Limits: Decide on how much of your income to allocate to each category.

- Review & Adapt: Budgets are not set in stone. Adjust yours as needed.

- Budget@Nerdwallet

Step 3 – Debt Doesn’t Have to Define You: Strategies for Debt Management

Carrying debt can feel like a massive weight on your shoulders. Whether you are dealing with credit card debt, student loans, or other loans, address it head-on.

- Get Organized: List down all your debt, their interest rates, and the minimum payments owed.

- Debt-Busting Strategies: Consider methods like the “debt avalanche” (tackling high-interest debt first) or “debt snowball” (paying off smallest balances first for quick wins).

- Get Creative: Can you make small lifestyle changes to save money for debt repayment? Explore potential side income opportunities.

Step 4 – Pay Yourself First: The Importance of Saving

This is a crucial financial planning concept. Every time you receive income, set aside a portion for savings before you spend on anything else. This ensures your financial future is prioritized.

- Start Small: Even saving 5% of your income makes a long-term difference.

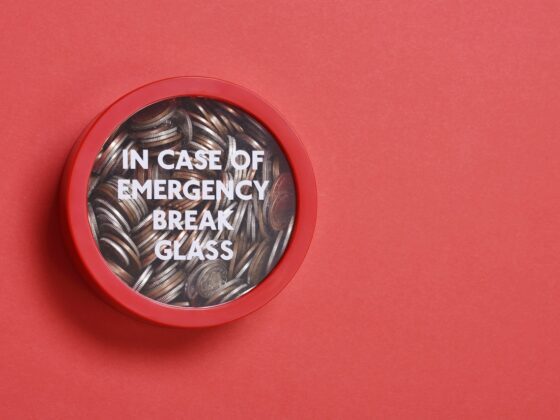

- Emergency Fund: Aim to build a fund of 3-6 months’ living expenses. This is your financial safety net.

- Set Goals: Create dedicated savings accounts for your dreams – vacations, down payments, whatever motivates you.

Step 5 – Financial Planning for the Future: Investing

Investing is key to building long-term wealth. Don’t let it scare you! Learn the basics:

- Understanding investments: Stocks (shares in companies), bonds (lending money), and mutual funds/ETFs (baskets of diverse investments).

- Retirement Accounts: Explore tax-advantaged retirement savings options. Does your employer contribute?

- Robo-advisors: If DIY investing isn’t your style, these platforms offer affordable automated investing.

- Compounding: Reinvesting your returns can supercharge your earnings over time.

Step 6 – Insurance: Protecting What Matters

Essential, but often overlooked, insurance is a vital part of financial planning.

- Analyze Your Needs: Health, life, disability, and renter’s/homeowner’s insurance all serve different but important purposes.

- Shop Around: Don’t just accept the first quote you get. Compare prices and policies carefully.

- Periodic Review: Insurance needs change over time. Update your coverage as your life changes.

Step 7 – Connect Your Finances to Your Dreams

Financial planning isn’t just about the numbers. It’s about using money to achieve your life goals.

- Define Your Why: What does financial security mean to you? Dream big!

- Visualize Your Goals: Use journaling, vision boards, or other creative tools to solidify your financial dreams.

- Stay Focused: Ignore comparisons with others. Stick to your own path and celebrate your progress.

Sometimes, a Helping Hand is the Best Investment

If financial planning feels overwhelming, there’s no shame in seeking help. A qualified financial advisor can be an excellent investment.

- Look for Credentials: Seek out advisors holding designations like CFP® (Certified Financial Planner™).

- Fee Structure: Understand how the advisor is compensated – fee-only or commission-based.

- Fiduciary Duty: This means the advisor is legally bound to put your interests first.

Your Journey Starts Now

Financial planning isn’t about getting rich overnight. It’s about delayed gratification and making sustainable choices. You can do this! Be patient, celebrate your successes, and never stop investing in your future.

Let me know if you have any questions!