Remember the most important lesson – spend less than you earn. A lot of the time it’s just as simple as that. Look for opportunities in your life to shave off your expenses and build a cash surplus. Besides this, here are 3 other tips to help you

To retire early and comfortably is the ultimate dream for many. We put up with your repetitive jobs and our annoying bosses in the hope that we can save enough. In this endeavor, we also try all sot of investment suggestions by friends’ colleagues. For most of us, this goal will be achieved over a period. You aren’t alone in this journey and so you can learn from the wisdom of others who have traveled this path.

1- Save 10%, Invest 10%

Take 10% fi your paycheck and save it and another 10% and put it into a low-risk investment

You’ve probably heard that you must save money but it’s equally important to invest and make your money grow. Saving 10% can contribute towards your emergency funds and investing the 10% can contribute towards our retirement.

Saving does not mean that you give up on the things you love doing. You can still take the trip you want or dine at the resultant you have your heart set on. It just means that you control your impulse purchase. Take some time to decide if you need something before you splurge. These small savings can help you build your wealth

Investing doesn’t need to be scary. Start with an index ETF or even a fixed deposit If you choose., Whatever you choose the returns must beat the inflation in the country. this ensures that you retain the purchasing power of your money

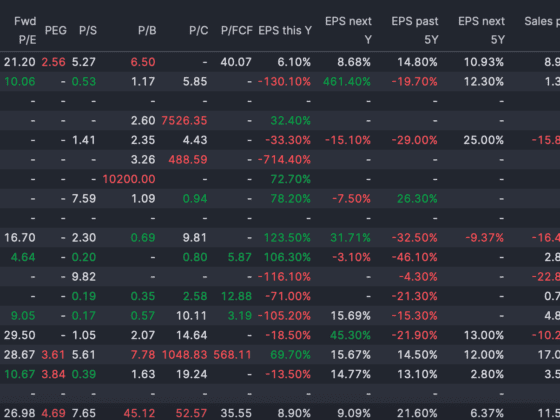

This forms a part of the 50/30/20 budget – a flexible may to managing your spending habits

50% of your income is kept for needs and fixed expenses

30% of your income is kept for wants and other expenses

20% of your income is kept for paying off debt than saving then investment (in that order)

This system offers the flexibility to increase or decrease the segment as per the situation of the month. I would always recommend to maintain it but everyone life situation is different

2 – Pay cash or pay more money down

Loans are a major part of our everyday lives. We take loans for our homes, our cars, our vacations. There was a time when back in the UAE were giving loans for yearly expenses like school fees and rent. You know that you’re in trouble when you need a loan to pay for such basic needs.

Debt either good or bad erodes your ability to save. It is highly recommended that you pay off any debt that you have in advance of other activities.

I try to avoid loans whenever I can. I have always bought used cars in a price range I can afford and I always opt to pay cash. This way I save a bunch of money on interest. This is not as hard to do as you might think. The trick is to buy or spend when you can afford to and always work with a budget in mind.

If the loan is unavoidable then I would opt to pay a larger value upfront to lower both my monthly payments and the interest it generates.

Online classifieds are a great way to buy expensive things cheap. People tend to splurge on the weekend and then a few months or years later decide they don’t need it and sell it. I’ve picked up many bargains on my home furniture, all the cars I’ve owned and so many other things. If you want to save there are always options to get it done

3 – Kids expenses – don’t need to break the bank

Bringing up kids is an expensive endeavor. Many of my friends shave 2-3 kids and one even has 7. Kids are expensive. An estimate in the US put the value of raising a child until the age of 18 to about $284,570. Although this value is different where you live one thing is certain that it will only keep rising.

The major expense includes housing and school fees. Housing is an easier solution where you can move further away from the city center to find the space you need at an affordable rate. This will increase your commute time but can be productive. You can listen or podcasts, read the news, plan your next project – anything that can help you develop.

School fees are a little trickier. you want your kids to have the best possible education that doesn’t always mean an expensive school. You remember my friend with the 7 kids he opted to home school his kids. If you have the time to dedicate then this would be the best option possible Here are some tips to get you started Saving money in today’s time is challenging but there are many