When it comes to relationships, money is often a subject that many couples tiptoe around, especially in the early stages. The idea of having a “money talk” can be intimidating, but it’s one of the most important conversations a couple can have. Financial compatibility is crucial for a healthy, long-lasting relationship, and the sooner you start discussing your financial goals, habits, and challenges, the better.

In this comprehensive guide, I’ll walk you through why every couple should have the money talk, how to approach the subject without killing the romance, and how to align your financial goals to build a stronger future together. I’ve learned these lessons the hard way, and I’m here to help you avoid some of the pitfalls I encountered.

Budgeting is often seen as a chore, something tedious that gets in the way of living your life. But what if I told you that budgeting could be the key to a more fulfilling, stress-free life? Over the years, I’ve discovered that a well-planned budget isn’t just about numbers—it’s about creating a roadmap to the life you want to live.

In this post, I’ll share with you why budgeting should be at the top of your priority list, especially if you’re in a relationship. You’ll learn how to have the money talk with your partner, set mutual goals, and build a financial plan that supports your dreams together.

Why Financial Compatibility Matters

One of the most common and lingering arguments couples have involves money. It’s a top cause of stress in relationships because financial issues are often tied to deeply held beliefs and values. A 2013 study by a Certified Divorce Financial Analyst found that money issues were the third leading cause of divorce (22%) behind basic incompatibility (43%) and infidelity (28%). When partners share similar financial values and goals, they’re more likely to find common ground in areas such as spending, saving, and investing, which can reduce friction.

The Impact of Financial Mismatches

Imagine this: You’re a saver, meticulously planning for the future, while your partner is a spender, living for the moment. While opposites may attract, these differences can lead to tension over time. A spender might feel restricted by a saver’s cautious approach, while a saver might feel anxious about a spender’s carefree habits. Without communication, these differences can escalate into serious conflicts.

The Benefits of Financial Alignment

On the other hand, when you and your partner are financially aligned, it sets the foundation for a stable and harmonious relationship. You’re able to make decisions together with a shared understanding of what’s important. This doesn’t mean you have to agree on everything—differences are natural—but it does mean that you’re willing to work together toward common goals.

How to Find Out If You’re Financially Compatible

To be clear, “the money talk” should be an ongoing conversation rather than a one-time event. Here’s how to find out if you’re on the same page and how well you could work together when it comes to managing finances as a couple.

Start with Observations

Erika Kaplan, vice president of membership at the matchmaking service Three Day Rule, advises her clients to start by observing behaviors early on to learn whether they’re dating a potential money match. “A really good indication of financial compatibility is how people like to spend their disposable income,” says Kaplan.

Although my husband and I didn’t directly talk about money right away, he recently revealed that he noticed certain behaviors during our dating stage that helped him understand my approach to money. He noticed I didn’t spend money excessively and opted to maintain my own hair and nails to stretch out the distance between salon visits, for example. My frugality, when it came to spending, helped convince him we would be a good money match.

Dream Together and Discuss Future Goals

Listing your future goals is another exercise you and your partner can try early in the dating process. Annette Harris, an accredited financial counselor with Harris Financial Coaching, runs this exercise with clients to help them assess financial compatibility. “I have clients list the top 10 things that they want to achieve over the next five to 10 years,” Harris says. “They compare that list together to see if they’re compatible.”

Some questions to consider during this exercise include:

- Do either of you plan to pursue additional education? How would you pay for it?

- Is homeownership a goal?

- Would either of you like to be married, and how would you pay for the wedding?

- Do you want to have children in the future? How many?

- Are either of you saving for something special? What is it, and why is it important to you?

When to Have the Money Talk

When you should start discussing money with your partner will vary based on your age and how quickly your relationship progresses.

Kaplan recommends you avoid asking for specifics about income, bank account balances, or credit scores right out of the gate. “Until you’re close to joining finances, I would recommend my clients ask more comfortable questions to gain an understanding of how they spend their money,” she says.

Softball questions—such as, “Are you a saver or a spender?”—keep the mood “cheeky and flirty” without coming across as an interrogation. She doesn’t advise divulging personal financial details until the relationship has matured and you both agree it’s leading toward a long-term commitment or engagement.

Red Flags You Should Never Ignore

Bad financial habits shouldn’t be ignored, but they aren’t an immediate reason to call a new relationship quits, either. “No one knows everything about money. One person may have a level of financial literacy and understanding that’s greater than the other partner because they’ve been exposed to more information,” says Cohen Taylor, a behavior wealth specialist at Wealth Enhancement Group.

Taylor thinks it’s important that a person is willing to communicate about money even if the topic makes them uncomfortable. If someone doesn’t open up about financial decisions or past mistakes, it can be difficult to develop new financial skills or knowledge.

She does think the dating process is a good time to assess whether a person engages in financially risky behaviors such as gambling. “You want to understand whether somebody is taking financial risks you’re not comfortable with,” Taylor says.

Financial dishonesty is also something she says you shouldn’t overlook. Even small money lies, such as a partner bragging about leaving a big tip when they only left a few dollars, can be a sign of problematic behavior, Taylor adds.

How to Have the Money Talk Without Killing the Romance

Now that you understand the importance of financial compatibility, it’s time to dive into how to approach the money talk without killing the romance.

Choose the Right Time and Place

The setting matters when discussing something as sensitive as money. Choose a time when you’re both relaxed and not in the middle of a stressful situation. A quiet dinner at home or a walk in the park can provide a comfortable environment for this conversation.

Start with Your Own Experiences

Instead of jumping straight into questions, start by sharing your own experiences with money. Talk about how you were raised to think about finances, your successes, and your challenges. This approach makes the conversation less about interrogation and more about mutual sharing.

Be Honest and Open

Honesty is key when discussing finances with your partner. Be open about your financial situation, including any debts or financial obligations you may have. This transparency builds trust and sets the stage for a healthy financial relationship.

Discuss Financial Goals

Talk about your financial goals, both short-term and long-term. Whether it’s buying a house, saving for a vacation, or planning for retirement, having shared goals can help you stay aligned and motivated.

Set Ground Rules

It’s important to set some ground rules when discussing finances. Agree to listen without judgment, avoid interrupting, and be respectful of each other’s perspectives. These rules can help keep the conversation productive and positive.

Make It an Ongoing Conversation

The money talk shouldn’t be a one-time event. Make it a regular part of your relationship. Whether it’s a monthly budget meeting or a quarterly financial check-in, keeping the lines of communication open will help you stay on the same page.

Building a Budget Together

Now that you’ve had the money talk, it’s time to put your plans into action by building a budget together.

Start with a Joint Financial Assessment

Before you can create a budget, you need to know where you stand financially. Start by assessing your combined income, expenses, debts, and savings. This assessment will give you a clear picture of your financial situation.

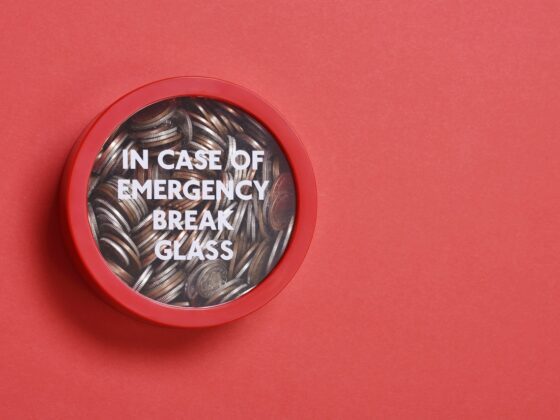

Set Shared Financial Goals

Once you have a clear understanding of your finances, set some shared financial goals. These goals could include paying off debt, saving for a down payment on a house, or building an emergency fund. Having shared goals will help you stay focused and motivated.

Create a Budget That Works for Both of You

When creating a budget, it’s important to take both partners’ spending habits and preferences into account. If one of you is a saver and the other is a spender, find a compromise that allows both of you to feel comfortable with the budget. This might mean setting aside a certain amount of money for discretionary spending while also prioritizing savings.

Track Your Progress

Once your budget is in place, track your progress regularly. This will help you stay on track and make adjustments as needed. Whether you use a budgeting app or a simple spreadsheet, the key is to stay informed about your finances.

Celebrate Your Successes

Finally, don’t forget to celebrate your successes. Whether it’s paying off a credit card or reaching a savings milestone, take the time to acknowledge your achievements as a couple. Celebrating these moments will keep you motivated and reinforce the positive aspects of managing your finances together.

Having the money talk with your partner is one of the most important steps you can take to ensure a healthy, long-lasting relationship. By discussing your financial goals, habits