Retire Before Mom & Dad by Rob Berger is a surprisingly accessible and encouraging playbook for those dreaming of financial independence—without giving up lattes or living like a monk. Berger, a former lawyer and personal finance YouTuber, blends clarity with practicality to demystify the path to early retirement.

This isn’t a FIRE (Financial Independence, Retire Early) manifesto heavy on extreme frugality. Instead, it’s a strategic guide that meets readers where they are—salaried, juggling bills, and wondering how to start investing without messing it up.

For readers across Asia and the Middle East—where salary-based income, family responsibilities, and savings culture vary widely—Berger’s message still resonates: early financial freedom is possible if you master your habits and systems.

5 Key Ideas or Takeaways

1. Time Is Your Greatest Asset

“Money grows exponentially. Start now. Start small. Just start.”

Berger emphasizes the brutal truth of compounding: the earlier you start, the better. This isn’t new—but the way he lays it out with real numbers and timelines makes it hit differently. It reminded me that even small, regular investments in your 20s can snowball into serious wealth.

2. Automate Everything

“You don’t need a six-figure salary. You need a system.”

Berger champions automation: direct-debit your savings, investments, and bills. It removes emotion from money decisions. This idea particularly applies in high-cash cultures like India or Egypt, where automation is underused. It’s not about more effort; it’s about smarter systems.

3. Know Your FI Number

“You can’t hit a target you haven’t set.”

One of the most empowering concepts is the Financial Independence (FI) number—the amount you need to live off your investments. Berger breaks it down simply: annual spending x 25. Calculating mine was eye-opening. Suddenly, retirement felt like a math problem, not a fantasy.

4. Cut Costs Without Cutting Joy

“Frugality is not deprivation. It’s optimization.”

Berger doesn’t preach austerity. He teaches value-based spending—spend lavishly on what you love, cut mercilessly on what you don’t. This is key in cultures where ‘status spending’ is common. His advice makes frugality feel empowering, not embarrassing.

5. Debt Is the Real Dream Killer

“Avoid lifestyle inflation. Destroy debt early.

This hits home for many professionals juggling loans, cards, or even buy-now-pay-later traps. Berger is clear: tackle high-interest debt with urgency. He offers a clear debt snowball plan, helping readers break free from the paycheck-to-paycheck cycle.

Action Plan: 5 Things to Do After Reading

1. Calculate Your FI Number

Use the simple rule: annual expenses × 25. You’ll now know the size of the portfolio you need to retire early.

2. Automate Your Savings

Set up auto-transfers to savings/investment accounts. If you’re in the UAE or India, platforms like Sarwa, Endowus, or Zerodha make this easy.

3. Track Spending for 30 Days

Use an app like YNAB, Wally, or even a Google Sheet to track every dirham or rupee. Awareness is the first step.

4. Pick a Low-Cost Index Fund

Berger loves index funds—and for good reason. Explore global ETFs through platforms like Interactive Brokers or local ones like Amaanah or StashAway.

5. Plan Your Debt Attack Strategy

List all debts, interest rates, and minimums. Choose the avalanche (highest interest first) or snowball (smallest balance first) method—and start this week.

Retire Before Mom & Dad is a straight-talking, hopeful, and practical book. It doesn’t promise magic. It promises clarity. For professionals in Asia and the Middle East navigating rising costs, shifting economies, and career pressure—it’s a breath of fresh air.

The book didn’t just inform me. It nudged me. To simplify. To calculate. To act.

If you’ve ever felt overwhelmed by financial advice, this book is your reset button.

Who Should Read This Book?

- Young professionals who want a smarter path to freedom

- People tired of living paycheck to paycheck

- New investors confused by jargon

- Those skeptical of extreme FIRE tactics

- Readers seeking balance between living well and saving smart

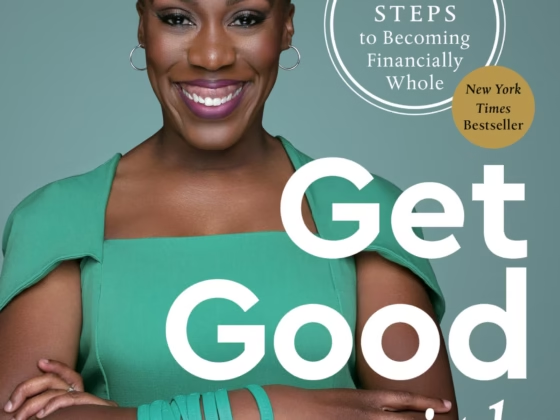

If You Liked This Book, You Might Also Like:

- The Simple Path to Wealth by JL Collins – a friendly intro to index investing

- I Will Teach You to Be Rich by Ramit Sethi – bold, practical advice with zero guilt

What Now?

Open your calculator. Find your FI number. Then ask: “What small step can I take this week to get closer to it?”

Start there. Berger would approve.