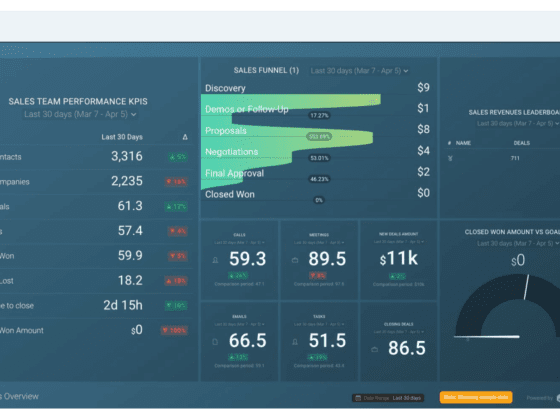

There are many different metrics that can be used to evaluate a company. Here are some key metrics to consider:

- Earnings per share (EPS): This metric measures the company’s profitability by dividing its net income by the number of outstanding shares of stock. A higher EPS is generally seen as a positive sign.

- Revenue growth: This measures the company’s ability to generate sales and can be a good indicator of its financial health. A company with strong revenue growth is generally seen as more attractive to investors.

- Gross margin: This measures the percentage of revenue that a company retains after accounting for the cost of goods sold. A higher gross margin can indicate a company’s ability to generate profits.

- Return on investment (ROI): This measures the amount of profit a company generates relative to the amount of capital it has invested in its business. A higher ROI is generally seen as a positive sign.

- Debt-to-equity ratio: This measures a company’s level of debt relative to its shareholder equity. A higher debt-to-equity ratio may indicate that a company is taking on too much debt and may be riskier for investors.

It is important to consider these and other metrics in the context of the company’s industry and overall financial health. It is also important to remember that past performance is not necessarily indicative of future results, and it is important to diversify your portfolio by including a mix of stocks, bonds, and other assets. I recommend consulting with a financial professional or doing your own research to learn more about evaluating companies and to determine the appropriateness of a particular company for your individual needs and goals.