Buying a car in Singapore can be a significant financial commitment, especially with the high costs. As seasoned traders and personal finance enthusiasts, we’ve learned much about making smart financial decisions. In this post, I’ll share ten tips to help you save money when buying a car in Singapore. By the end of this blog post, you’ll understand how to navigate the car-buying process while keeping your personal finances in check.

1. Establish a Clear Budget

Establishing a budget is the first and most crucial step in personal finance. Knowing how much you can afford to spend on a car will help you narrow your choices and prevent overspending. Consider the purchase price, insurance, road tax, fuel, maintenance, and parking costs. A well-thought-out budget will keep you grounded and ensure you don’t overextend your finances.

2. Consider the Total Cost of Ownership

The initial price tag of a car is just the beginning. In Singapore, you must also factor in the Certificate of Entitlement (COE), which can be a substantial cost. Additionally, consider the long-term expenses such as fuel efficiency, maintenance, insurance premiums, and depreciation. Understanding the total cost of ownership is vital for maintaining healthy personal finances.

3. Explore Financing Options

There are various ways to finance a car purchase, each impacting your personal finances differently. You can pay in full with savings, take a bank loan, or use in-house financing from car dealerships. To find the most cost-effective option, it’s essential to compare the interest rates, loan tenure, and repayment terms. Remember, the lower the interest rate and shorter the loan term, the less you’ll pay in the long run.

4. Shop Around for the Best Deals

Don’t settle for the first offer you get. Take your time to visit multiple dealerships, compare prices, and ask for quotes. Look for promotions, discounts, or trade-in deals that can lower the overall cost. As experienced traders, we know that patience and thorough research can lead to significant savings.

5. Consider Buying a Used Car

Buying a used car can be a smart financial move, as it can save you a considerable amount of money compared to a brand-new one. However, it’s crucial to do a thorough inspection and get a trusted mechanic to check the car’s condition. Ensure the vehicle has a clean history with no outstanding loans or serious accidents. This way, you’ll avoid potentially costly repairs down the line.

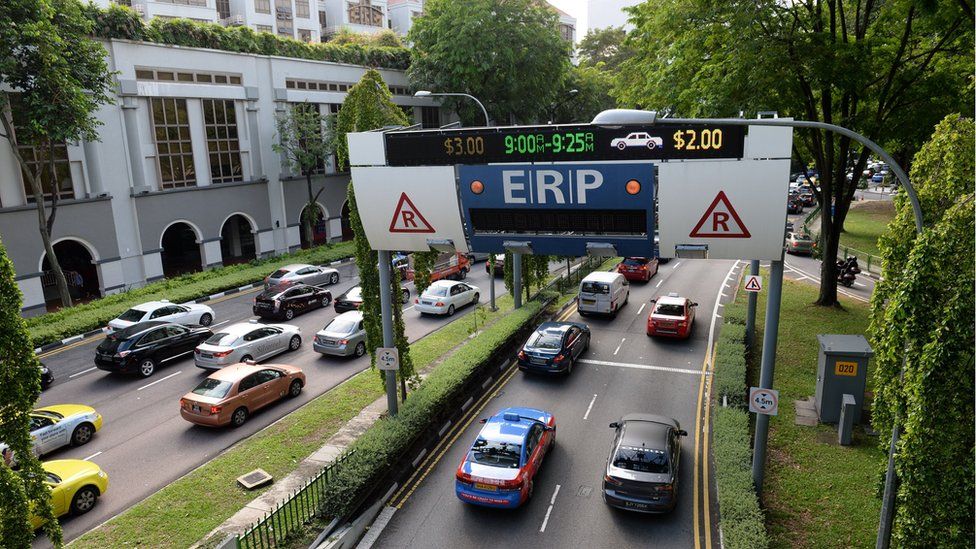

6. Evaluate the COE Trends

The COE is a significant factor in buying a car in Singapore. Monitor the COE trends and try to time your purchase when COE prices are lower. Websites and forums often discuss COE predictions and can provide insights into the best buying times. Lower COE prices can significantly reduce the total amount you spend on your car.

7. Negotiate the Price

Don’t be afraid to negotiate the price with the dealer. Most dealers expect some haggling and have room to move on the price. Use quotes from other dealerships as leverage, and don’t hesitate to walk away if the price isn’t right. Effective negotiation can lead to substantial savings and is a crucial skill in personal finance.

8. Check for Rebates and Incentives

The Singapore government occasionally offers rebates and incentives for certain car types, especially environmentally friendly vehicles. Look out for these incentives, as they can reduce your overall cost. Check the Land Transport Authority (LTA) website for any current rebates or schemes you might be eligible for.

9. Consider the Resale Value

When choosing a car, think about its resale value. Some brands and models depreciate slower than others. Research which cars retain their value better and consider those options. A car with a higher resale value will be a better long-term investment and can positively impact your personal finances when it’s time to sell.

10. Maintain Good Personal Finance Practices

Lastly, maintaining good personal finance practices is essential. This means not just planning for the car purchase but also managing your finances wisely in general. Set aside an emergency fund, avoid high-interest debts, and keep track of your spending. Healthy personal finance habits will ensure you can comfortably afford your car and other financial commitments.

Saving money when buying a car in Singapore requires a combination of smart budgeting, thorough research, and savvy financial decisions. By following these ten tips, you can make a significant purchase without jeopardizing your personal finances. Remember, the goal is to make an informed decision that aligns with your financial goals and ensures long-term stability.