Your 20s are a fantastic, whirlwind decade! You’re navigating fresh freedoms, making life-altering decisions, and laying the groundwork for your future. Along the way, though, financial missteps are easy to make, and this is where “mistakes in your 20s” come in as a key focus area. The current educational system leaves many of us unprepared for the complexities of money management. Let’s dive into common pitfalls of this exciting life stage and how to sidestep them skillfully.

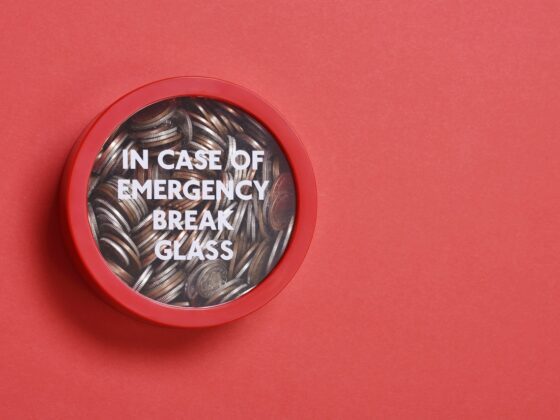

Mistake #1: No Rainy-Day Fund

I get it – retirement planning feels far-fetched when you’re in your 20s. But establishing a savings habit now, even a small one, has an extraordinary impact over time. You’ll thank yourself later! Here’s how to tackle this “mistake in your 20s”:

- Start Small, End Big: Even a modest amount saved monthly makes a difference. The act of saving consistently is what matters most.

- Target 3 Months’ Expenses: Ideally, build an emergency fund that covers three months of your living costs. This buffers you from relying on high-interest credit cards during unexpected situations.

- Automation Is Your Friend: Set up automatic transfers to your savings account, so you don’t even have to think about it.

Mistake #2: Flying Blind Without a Budget

“Mistakes in your 20s” often involve impulsive spending. A budget is your secret weapon. It illuminates where your money comes from, and where it goes, and helps you curb unnecessary expenses. Here’s how to get started:

- List Your Income & Expenses: This is your financial snapshot. Itemize income sources, then recurring expenses like rent, bills, and subscriptions.

- Embrace the Tools: Budgeting apps, Excel spreadsheets, or even pen and paper – whatever works for you!

- Track and Tweak: Monitor your spending and adjust your budget as needed. It’s a dynamic tool!

Mistake #3: The Credit Card Trap

Getting your first credit card is exciting, but “mistakes in your 20s” can involve reckless spending. Remember, a credit card isn’t free money, and misuse has long-term consequences. Here’s how to use credit wisely:

- Don’t Overspend: Treat it like an extension of your bank account. Stick to budgeted spending.

- Pay in Full, Every Time: Interest charges negate any ‘rewards’ and spiral into debt.

- Limit Your Cards: Start with one or two. Having too many can be tempting.

Mistake #4: Shunning the Stock Market

Investing may seem scary, but avoiding it is one of the biggest financial “mistakes in your 20s.” Time is your greatest asset! The earlier you start, the more your money has the potential to grow. Start small, but start now:

- Index Funds for Beginners: Look into low-cost index ETFs (exchange-traded funds) that mirror the S&P 500.

- Dollar-Cost Averaging: Invest a set amount regularly, even during market dips. This strategy smooths out costs over time.

- Prioritize Emergency Savings: Don’t neglect your rainy-day fund in favor of investing.

Mistake #5: Giving in to Impulse Buys

Dubai is a playground of temptations, and impulse purchases are a classic “mistake in your 20s.” Resist the urge to keep up with appearances or chase fleeting trends. Here’s how to combat impulse buys:

- The 24-Hour Rule: Before purchasing, wait a day. Do you still need it, or has the urge passed?

- Question the ‘Why’: Are you buying for status, boredom, or genuine need?

- Focus on Experiences: Invest in memories rather than possessions. They bring more lasting joy.

Mistake #6: Burning Through Money on Cars

Cars, especially fancy ones, are financial black holes. Depreciation hits the moment you drive off the lot. It’s one of the most common “mistakes in your 20s,” so choose wisely:

- Depreciation is Real: Understand that a car’s value drops by 10% or more its first year alone.

- Used is Smarter: Consider slightly older models that hold value better. Let someone else take the depreciation hit.

- Public Transport is Viable: Explore buses, the metro, or carpooling to save big

Mistake #7: Overlooking the Power of Comparison

It pays (literally!) to compare prices before committing to any significant purchase. Don’t fall for the first offer you see. Resources are at your fingertips:

- Online Comparison Sites: Websites like [pricena.com] ([invalid URL removed]) aggregate product prices from various retailers.

- Insurance Aggregators: For car or health insurance, use [insurancemarket.ae] (https://insurancemarket.ae/) to find the best rates.

- Coupon Codes: Always search for online promo codes before checkout. Sites like CouponGenie Store can help.

Additional Mistakes

Mistake #8: Not Investing in Yourself

Your earning potential is your greatest asset. In your 20s, invest in personal and professional growth. This pays dividends throughout your career. Here’s how:

- Upskilling: Take online courses, workshops, or certifications that boost your skills and value in the job market.

- Networking: Build relationships within your industry. Mentors can open doors and provide invaluable guidance.

- Passion Projects: Explore side hustles that develop skills and could even turn into future income streams.

Mistake #9: Putting Off Health and Wellness

Your health is your wealth, yet “mistakes in your 20s” often involve neglecting it. Bad habits formed now compound over time. Prioritize your well-being!

- Healthy Eating: Fuel your body with nutritious foods—it affects your energy levels, mood, and long-term health.

- Exercise is Key: Aim for regular physical activity. It doesn’t have to be fancy gym sessions – walking, dancing, or sports count too!

- Prioritize Sleep and Mental Health: These are often overlooked but vital for your overall well-being and your ability to perform.

Mistake #10: Forgetting the Power of Travel

Yes, travel can be expensive, but its life-changing benefits make it a worthwhile investment in your 20s. Here’s how to make it work:

- Budget Travel: Hostels, off-season trips, and local experiences offer immersive adventures on a budget.

- Prioritize Learning: Travel expands your worldview, exposes you to new cultures, and fosters personal growth.

- Work/Travel Opportunities: Consider teaching English abroad, volunteering, or finding remote work that allows for travel.

Mistake #11: Ignoring Your Long-Term Goals

It’s easy to get caught up in the present, but neglecting long-term planning is a common “mistake in your 20s.” Consider what really matters to you:

- Define Your Dreams: Homeownership? Early retirement? Starting a business? Write these goals down!

- Break Them Down: Create smaller, achievable milestones that lead to your bigger vision. Regularly review and adjust your plan.

- Financial Advisors: If it feels overwhelming, a financial advisor can guide you toward tailored strategies.

Your 20s are filled with potential, and avoiding these common “mistakes in your 20s” sets you up for a robust financial future. Remember, small changes today yield big results down the line. Embrace budgeting, saving, wise investing, and making conscious choices. You have the power to design the life you want!